By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

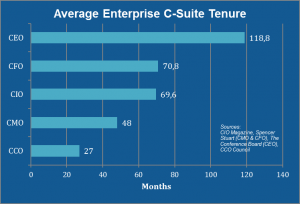

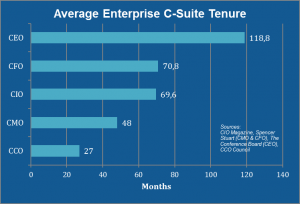

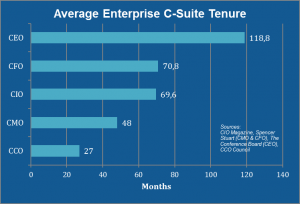

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

r officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:it]

By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

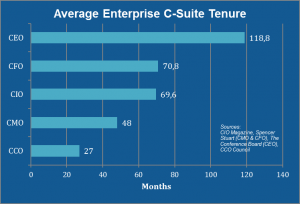

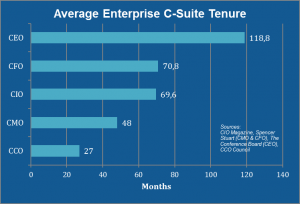

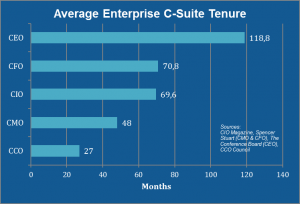

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:ja]

By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

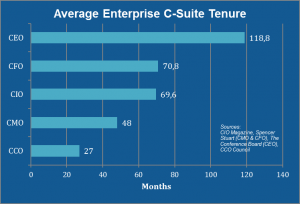

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:pb]

By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

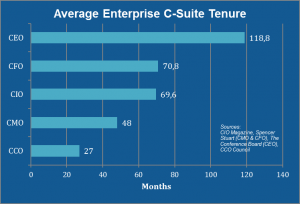

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:es]

By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

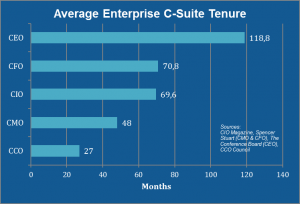

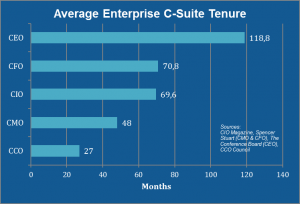

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

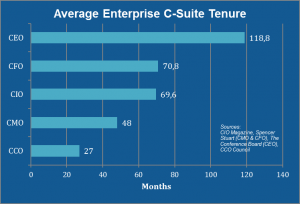

Source: 2015 CCO Council Tenure Study

Source: 2015 CCO Council Tenure Study

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

r officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

r officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:it]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

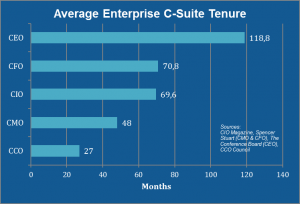

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

[:it]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:ja]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

[:ja]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:pb]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

[:pb]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

[:es]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

[:es]By Curtis N. Bingham, CEO, Chief Customer Officer Council

Companies are adopting the chief customer officer (CCO) role at a faster pace, and keeping them in their roles longer, especially in larger companies. The greatest obstacles to the success of the CCO and by extension the proliferation of customer centricity and experience initiatives is the inability to demonstrate quantitative ROI and as a result, demonstrate value to the CEO.

A hot seat

The chief customer officer is defined as the senior-most executive driving customer strategy across the highest levels of the company and having unique accountability for increasing customer value. According to the 2015 CCO Tenure Study conducted by the Chief Customer Officer Council, 36% of known CCOs are employed by Enterprise, 50% by small, and the remaining 14% by mid-size companies. At 27 months, the enterprise CCO tenure is the shortest of the C-suite.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Source: 2015 CCO Council Tenure Study

The need for evidence

There are two huge challenges that CCOs face that limit their tenure and more importantly, their ability to better serve customers: the inability to demonstrate ROI of customer initiatives and related, the inability to demonstrate clear value to the CEO. Without a seat at the CEO’s table, customer initiatives are often viewed as discretionary and suffer whenever there is a revenue roadbump. While many CCOs and customer executives are using NPS or some other loyalty metric in an attempt to quantify their results, most have not demonstrated a financial linkage to loyalty measures. As an example, JetBlue found that each detractor converted to promoter is worth $40 additional profit and each 1-point overall NPS gain yields a $5-8M increase in annual revenue. Comparing increases and losses from promoters and detractors respectively, it might take 36,000 promoters to increase revenue by $1M, but only 14,000 detractors to realize a revenue loss of $1M. Presented with these types of numbers, the CEO and CFO were extremely interested in and supportive of the initiatives underway to improve the customer experience and the requisite increase in customer centricity within the organization.

CLTV, SOW, ROI: Quantitative measures of value

What are CCOs doing to address this gap? There are three types of measures of CCO success: relational, qualitative, and quantitative. Many CCOs begin with relational measures: getting the CEO support for initiatives based on the promise of future results. However, there is a time or event horizon by which results must be demonstrated lest support wane or be cut off. Many customer executives are using qualitative metrics measuring perception and of relationship health, intent to repurchase, willingness to recommend (NPS), etc. As sexy as these numbers are, they are of minimal use in the absence of financial correlations. The most successful customer executives are using quantitative measures that demonstrate their impact on revenue, costs, and especially changes in these metrics over time as a result of changes in customer behavior. Metrics include customer lifetime value (CLTV), share of wallet (SOW), time to revenue, upsell/cross sell, and customer ROI (adoption of the customer’s measures of success).

Earning a seat at the table

The most successful CCOs are demonstrating their value, earning a seat at the CEO’s table, and their ability to improve customer value by measuring their impact on financial metrics. Customer executives need more and better and more comprehensive quantitative measures that demonstrate how customer behavior is changing as a result of customer initiatives, and the impact of this change on company financials.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.

Curtis Bingham is the world’s foremost authority on the customer-centric organization. He was the first to promote the role of chief customer officer as a catalyst for competitive advantage. He is the creator of the first CCO Roadmap and the Customer Centricity Maturity Model. He is the founder of the Chief Customer Officer Council, a powerful and intimate gathering of the world’s leading customer executives. As an international speaker, author, and consultant, Curtis is passionate about creating customer strategy to sustainably grow revenue, profit, and loyalty.