The short answer is many are not, and I’ll tell you why

As 2020 is just around the corner, I’m asked more and more whether Insights functions are fit for the demands of the next decade. My answer is that unfortunately most are not. In fact, many are facing budget cuts as they are simultaneously being asked to do more and more. Fortunately, some Insights functions are ready and are being given the extra resources to be fit for the 2020’s. Why is this?

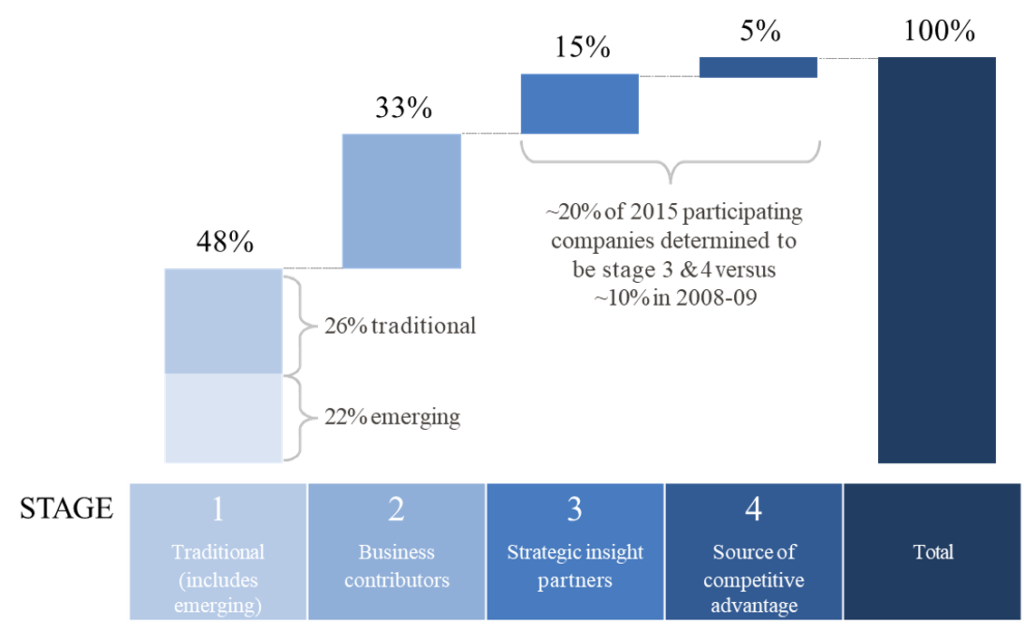

I imagine many of you are familiar with the Insights Function Maturity Model which was deployed by BCG, Cambiar and Yale to benchmark the maturity of the Insights function. If you are not, then a good place to read more about this model is in the BCG-GRBN report on the ROI of Insights, which you can access from here.

The benchmarking was carried out in 2009 and again in 2015, and as the chart below shows most Insights teams remain in the lower two boxes:

An Insights leader recently asked me what is the situation now? As the study has not been updated since 2015 (at least not yet), I can only give me opinion on what has happened. This opinion is, however, informed by the experiences of more than 500 Insights leaders we have either interviewed, talked to or worked with over the last year.

My short answer is that some progress has been made from stage 2 to stage 3, but almost no progress has been made towards stage 4.

Some shift from stage 2 to 3

Firstly, let’s look at how Insights functions are shifting from stage 2 to stage 3 in order to become strategic business partners. There are three ways this is principally happening:

- More of the Insights functions we talk to are doing more product/service/process improvement research, i.e. agile research. This enables them to give immediately actionable insights and recommendations to the business.

- More Insights functions are embedding staff in the business units, which enables them to be more proactive responding to business needs and available to advise decision-makers in the moment.

- More Insights functions are deploying CI knowledge management tools for self-service of data and insights.

Further good news is that some progress is also being made towards stage 4 on a couple of key metrics:

- Some Insights functions are doing a better job at integrating multiple data sources to provide a single point of view on the customer/consumer. This is partly driven by restructuring, which is bringing Customer Insight (CI) and Customer Analytics (CA) into the same team (or at least under the same boss). Some organizations are also managing to integrate Customer Experience (CX) into the same group.

- Some Insights functions are deploying more advanced (machine-learning-based) knowledge management systems allowing them to create a learning organization both within and without the Insights function.

Little progress towards stage 4

But, as you can imagine based on the title of this thought-piece, there are many areas in which Insights functions have made little or no progress, which is partly hindering their ability to become true strategic business partners and severely hindering their ability to become a source of competitive advantage in their businesses:

- Insights functions have made little or no progress on measuring their ROI and demonstrating their business impact. At the same time other functions, such as CX and Digital Marketing, have been doing this with gusto. Simply put, budget is going towards those who measure and demonstrate their value, away from those who don’t.

- Few Insights functions have made progress in taking a more active role in decision-making, either as having a role in setting the business agenda or vetoing decisions. In the few cases we know of, where this is the case, the impact is huge.

- Relatively few Insights functions are investing significantly in strategic, innovative/new, forward-looking, and predictive Insights work. Much more needs to be invested in modelling for example. A greater proportion of budget needs to be reserved and used for innovation/experimentation. Where significant investment is made in strategic work, for example, in segmentation work, the work often falls flat because Insights does not play a strong enough role in implementing the Insights from this work.

- Only a few Insights functions are investing in developing business consultancy expertise within the CI team, either through training or through new recruitment strategies. One concern is that we know from the WFA/System 1 research that there is a huge mismatch between how Insights professionals see themselves and how the business decision-makers see Insights professionals as strategic consultants. Basically, half of Insights functions are doing nothing to develop their competency here when they should be because of this dillusion.

- Few Insights functions are radically changing their external partner programs. In fact, many are moving in the wrong direction. Firstly, they are allowing procurement to dominate, making cost rather than business value the number one decision-making criteria. Secondly, many Insights functions, in their drive to hit their budget efficiency KPIs are in-sourcing, rather than outsourcing, low value-add and commoditized activities.

So, what does this mean for 2020?

For Insights function leaders, it means that if you want to be fit for the next decade and increase your resources, you urgently need to get going creating and implementing a Business Impact Maximization strategy. A good place to start with that is here.

Experience tells us that standing still is not an option, so if you are not ready to embrace this brave new world then, you will more likely than not see decreasing budgets and decreasing headcount in your future. You will become less and less effective as a result.

For agency leaders, it means that you have a huge stake in helping your clients progress from stage 2 to stage 3 and ultimately to stage 4 as quickly as possible. It means you need to be proactive and even invest in making this happen. The ROI calculation of doing vs not doing this speaks for itself.

Whichever side of the client-agency table you sit, good luck in making wise choices over the next couple of months. The future depends on it.

Andrew Cannon

Andrew Cannon

Executive Director

GRBN